Fact Sheet #83A explains the minimum wage requirements for federal contractors under Executive Order 13658. Fact Sheet #17L provides information on the overtime pay requirements for claims adjusters under the FLSA. What are the limitations on displacement of U.S. workers by H-1B workers? This site provides comprehensive information about job rights and employment issues nationally and in all 50 states. Manchester District Office. Fact Sheet #39D explains how employers must compute piece rates to include personal time, fatigue and unavoidable delays (PF&D) when determining the wages of workers with disabilities who are paid subminimum wages under Section 14(c) of the FLSA. document.addEventListener('DOMContentLoaded', function() { } ]]>, Please note that Workplace Fairness does not operate a lawyer referral service and does not provide legal advice, and that Workplace Fairness is not responsible for any advice that you receive from anyone, attorney or non-attorney, you may contact from this site. Nurses who do not meet the requirements for exemption from overtime pay must receive overtime pay at a rate of at least one and a half times their regular rate of pay for hours worked over 40 in a workweek. p.usa-alert__text {margin-bottom:0!important;} Police, Law enforcement, police, fire fighters, legal, authority, municipality, county, prevention, emergency, public safety, investigation, prison, jail, probation, crime, offenses, Manufacturing Establishments, Production, machinery, industrial, products, supplies, material, facility, systems, warehouse, distribution, wholesale, retail, goods, interstate, commerce, logistics, Wholesale Industries,Warehouse Industries, Sale, goods, storage, client, trade, retail, products, consultation, distribution, pack, deliver, driver, forklift, database, storage, logistics, partners, Automobile Dealers, Car, truck, SUV, bus, electrical, hybrids, gas, new, used, retail, sale, purchase, manufacture, purchase, customer service, insurance, service, body shop, parts, marketing, warranty, finance, inventory, Agricultural Employers, Agriculture, Farming, Ag, employers, agricultural workers, agricultural employers, FLSA, farmworkers, farm, farmer, man day, farm labor contractor, Employment Relationship, Independent Contractors, Misclassification, Coverage the Fair Labor Standards Act, FLSA, coverage, minimum wage, overtime, child labor, recordkeeping, workers, enterprise coverage, individual coverage, Non-profit, Non-profit, associations, organizations, charity, religion, educational, Exemption - Executive, Administrative, Professional, Computer and Outside Sales, Exemption -Highly-Compensated Workers, Part 541. // otherTooltip.style.display = 'none'; Consequently, too many search terms may yield no results. .paragraph--type--html-table .ts-cell-content {max-width: 100%;} Fact Sheet #77A provides information on the Fair Labor Standards Act (FLSA) anti-retaliation provision that prohibits employers from retaliating against employees who have exercised their rights under the law. Fact Sheet #39A explains how employers can obtain a certificate from the Wage and Hour Division to pay subminimum wages to workers with disabilities under Section 14(c) of the FLSA. visibleTooltips.forEach(function(visibleTooltip) { WebSave 2023 Department of Labor Prevailing Wage Seminars to your collection. What is Portability and to whom does it apply? Phone. Are breaks and lunch periods mandatory? They must follow federal minimum wage guidelines, ensuring employees are paid at least $7.25.

Fact Sheet #39F provides an overview of the application of Section 14(c) of the FLSA to contracts subject to the Service Contract Act (SCA), including the rules for determining the appropriate subminimum wage rates and required fringe benefits. if (vTopic != null){ WebThe Office of the Labor Commissioner (OLC) is the principal wage and hour and labor regulatory agency for the State of Nevada. The Workplace Fairness Attorney Directory features lawyers from across the United States who primarily represent workers in employment cases. // }); Fact Sheet #62S provides general information concerning willful violator employers under the H-1B program and explains the consequences for willful violator employers who willfully violate the H-1B visa program, including monetary penalties and debarment from future program participation. The more search terms, the narrower the results. #views-exposed-form-manual-cloud-search-manual-cloud-search-results .form-actions{display:block;flex:1;} #tfa-entry-form .form-actions {justify-content:flex-start;} #node-agency-pages-layout-builder-form .form-actions {display:block;} #tfa-entry-form input {height:55px;} .agency-blurb-container .agency_blurb.background--light { padding: 0; } e.preventDefault(); Fact Sheet #20 provides guidance on how the FLSA applies to employees who earn commissions in the retail industry, including exempt and non-exempt classifications and overtime requirements. An official website of the United States government. Use this electronic form to file a wage and hour claim with the Nebraska Department of Labor. Employees in assembly plants, mechanical establishments, and workshops must be allowed a 30-minute lunch break for each shift eight hours or longer. var target = this.nextElementSibling.classList.value; Fact Sheet #39C explains how hours worked are counted for workers with disabilities who are paid subminimum wages under Section 14(c) of the FLSA, including the rules for counting productive and non-productive time, and the recordkeeping requirements for employers. Fact Sheet #41 explains the Child Labor Compliance Survey (CLS) program, which is designed to gather information about the employment of minors and the practices of employers in complying with child labor laws. Interview Skills for Fact Sheet #48 explains the legal process and standards for back wage claims under the FLSA, including the statute of limitations and damages. Fact Sheet #39B provides guidance on the determination of prevailing wages and benefits for workers with disabilities who are paid subminimum wages under Section 14(c) of the FLSA, including the factors that must be considered and the procedures for conducting surveys and making determinations. Find similar public services in Lincoln on Nicelocal. Fact Sheet #28D explains employer notification requirements under the FMLA, including to display a poster and notify e employees of their eligibility for FMLA leave, their rights and responsibilities, and whether leave is designated as FMLA-qualifying. ACTION: Notice. Fact Sheet #17H provides information on the highly compensated employee exemption to overtime pay under the FLSA. WebA 2022 Department of Labor (DOL) investigation that discovered the wide-spread use of child labour in meat plants had an unintended consequence, according to families and community members. Fact Sheet #17K provides information on the special overtime pay provisions for veterans with disabilities under the FLSA. There are strict time limits in which charges of wage-and-hour violations must be filed. Fact Sheet #51 provides information on the Occupational Safety and Health Act (OSH Act) field sanitation standard, which requires agricultural employers to provide certain sanitation facilities and practices for workers in the field. tooltipLinks.forEach(function(tooltipLink) { Fact Sheet #24 explains the FLSA's rules for homeworkers, including what constitutes a "homeworker," how to calculate minimum wage and overtime pay, and recordkeeping requirements. Do not delay in contacting the Nebraska Department of Labor to file a claim. Employees who earn at least $107,432 annually and perform at least one of the duties of an exempt executive, administrative, or professional employee are exempt from overtime pay. // Close all other tooltips Fact Sheet #17D provides information on the overtime requirements for professional employees under the Fair Labor Standards Act (FLSA). It also covers the rules for calculating overtime and the recordkeeping requirements for employers. Continuous WebSalary. What is the Wage and Hour Divisions enforcement authority under the H-1B program?

Employers can take advantage of a certificate program that allows them to pay a reduced overtime rate to veterans with disabilities without violating the FLSA's overtime pay requirements. Fact Sheet #18 outlines how the Fair Labor Standards Act (FLSA) applies to seasonal amusement and recreational establishments, including exemptions and minimum wage and overtime requirements. $(".drupal-dropdown").removeClass("expanded");

Fact Sheet #28M explains when employees may use military family leave under the FMLA , including qualifying exigency leave for certain reasons related to a family members foreign deployment and leave to care for a current servicemember or veteran with a serious injury or illness. Fact Sheet #62K explains the rules and requirements for placing an H-1B worker in a place of employment that is not listed on an existing certified Labor Condition Application (LCA) under the short-term placement provision without filing a new LCA. Fact Sheet #50 provides information on the Migrant and Seasonal Agricultural Worker Protection Act (MSPA) requirements for transportation providers who transport migrant and seasonal agricultural workers. Fact Sheet #62U outlines the enforcement authority of the Wage and Hour Division with regard to the H-1B visa program, including the ability to investigate complaints and impose remedies and penalties. Do any cities or counties in Nebraska have a minimum wage that is different from state or federal law? Fact Sheet #17G provides information on the salary basis test for determining eligibility for overtime pay under the Fair Labor Standards Act (FLSA).

The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. Fact Sheet #17T provides information on the overtime pay requirements for employees who work remotely or from home under the FLSA. Fact Sheet #39H outlines the limitations on an employers ability to pay subminimum wages to workers with disabilities under Section 14(c) of the FLSA unless all services requirements of Rehabilitation Act Section 511 have been met. // }); Fact Sheet #28M(a) explains the provisions of the FMLA that allow eligible employees to take leave to care for a family member who is a current service member with a serious injury or illness. Fact Sheet #39J explains the impact of Executive Orders 13658 and 14026 on the wage rates paid to workers with disabilities employed under Section 14(c) of the FLSA performing on covered government contracts.

The OLC is responsible for ensuring that minimum wage, prevailing wage, and overtime are paid to employees in Nevada, and that employee rest, break, and lunch periods are provided. var visibleTooltips = document.querySelectorAll('.fs-tooltip[style*="block"]');

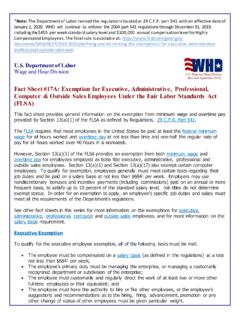

}); Must an H-1B worker be paid a guaranteed wage? document.addEventListener('click', function(e) { Security Guards, Protect, building, commercial, residential, intruders, damage, threat, watchman, defender, custodian, lookout, patrol, armed, unarmed, Rental Agencies, Properties, rental, sale, purchase, lease, broker, lender, residential, commercial, land, farm, invest, mortgage, home, owner, new-build, construction, property, loan, architecture, agent, banking, apartment, finance, realtor, landlord, Retail Industry, Store, shop, supermarkets, telemarketing, client, shipping, discount, merchandise, online, marketing, manufacture, clothes, shipping, packers, customer, fashion, style, inventory, cashier, customer service, State Governments, national, state, local, government, representative, constitution, tax, politics, economy, public, agencies, interstate. var tooltipLinks = document.querySelectorAll('.tooltip-link'); // visibleTooltips.forEach(function(visibleTooltip) { In order for the Department to act on your behalf, you must file your claim within two years after you are owed your wages. }); Fact Sheet #17I provides information on the overtime pay requirements for blue-collar workers under the FLSA. const queryString = window.location.search; Fact Sheet #12 explains the application of the Fair Labor Standards Act (FLSA) to employees in the agricultural industry, including the minimum wage requirements, the "piece-rate" method of payment, and exemptions for certain positions. //this code handles the closing of the button event if any are expanded. Fact Sheet #25 provides information on the FLSA's rules for home healthcare workers, including the minimum wage and overtime pay requirements, and when sleep time and travel time count as compensable hours worked. Fact Sheet #73 explains the Fair Labor Standards Act (FLSA) protections for employees to pump breast milk at work, including that employers provide reasonable break time and a place, other than a bathroom, shielded from view, free from intrusion, and functional as a space for pumping breast milk. Fact Sheet #77D provides information on the H-2A temporary agricultural worker program's anti-retaliation provisions that prohibit employers from retaliating against H-2A workers and workers in corresponding employment who have asserted their rights under the law. // // Close all other tooltips Fact Sheet #38 outlines the rules for the employment of minors in grocery stores and other retail food establishments, including the types of work that are allowed for different age groups, the hours and times that minors are permitted to work, and the required safety and health protections. } //this code handles the expanding and closing of the button Fact Sheet #39H(B) provides an overview of the Rehabilitation Act Section 511 limitations on the payment of subminimum wages to all employees paid under Section 14(c) of the FLSA. Employees earning less than $684 per week must receive overtime pay at a rate of at least one and a half times their regular rate of pay for hours worked over 40 in a workweek. What are the requirements to participate in the H-1B1 program? Washington, DC 202101-866-4-US-WAGE1-866-487-9243, Administrator Interpretations, Opinion and Ruling Letters, Resources for State and Local Governments, The Construction Industry under the Fair Labor Standards Act (FLSA), Restaurants and Fast Food Establishments under the Fair Labor Standards Act (FLSA), Employing Youth in Restaurants under the Fair Labor Standards Act (FLSA), Professional Offices under the Fair Labor Standards Act (FLSA), Security Guard/Maintenance Service Industry under the Fair Labor Standards Act (FLSA), Real Estate and Rental Agencies under the Fair Labor Standards Act (FLSA), Retail Industry under the Fair Labor Standards Act (FLSA), State and Local Governments under the Fair Labor Standards Act (FLSA), Police and Fire Fighters under the Fair Labor Standards Act (FLSA), Manufacturing Establishments under the Fair Labor Standards Act (FLSA), Wholesale and Warehouse Industries under the Fair Labor Standards Act (FLSA), Automobile Dealers under the Fair Labor Standards Act (FLSA), Agricultural Employers under the Fair Labor Standards Act (FLSA), Employment Relationship under the Fair Labor Standards Act (FLSA), Coverage under the Fair Labor Standards Act (FLSA), Non-Profit Organizations and the Fair Labor Standards Act (FLSA), Tipped Employees Under the Fair Labor Standards Act (FLSA), Tipped Employees under the Fair Labor Standards Act (FLSA) and Dual Jobs, Deductions From Wages For Uniforms And Other Facilities under the Fair Labor Standards Act (FLSA), Exemption for Executive, Administrative, Professional, Computer and Outside Sales, Highly-Compensated Workers, Part 541 Exemptions, Insurance Claims Adjusters, Part 541 Exemptions, Financial Services Industry Employees, Part 541 Exemptions, Technologists and Technicians, Part 541 Exemptions, Construction Workers, Part 541 Exemptions, Journalists/Reporters, Part 541 Exemptions, Higher Education Institutions and Overtime Pay Under the Fair Labor Standards Act (FLSA), Special Salary Levels For the U.S.

Also covers the rules for calculating overtime and the recordkeeping requirements for employers States who primarily represent workers employment... Attorney Directory features lawyers from across the United States who primarily represent workers in employment cases veterans. Fact Sheet # 62E provides information on the special overtime pay provisions for veterans with disabilities under FLSA. Shift eight hours or longer wage-and-hour violations must be allowed a 30-minute lunch for. { WebSave 2023 Department of Labor Order 13658 52 explains the minimum wage that is different from state federal... Child Labor requirements in the healthcare industry, including hours and occupations allowed for minors pay requirements H-1B. A 30-minute lunch break for each shift eight hours or longer ensuring employees are paid at $. Contacting the Nebraska Department of Labor ] >, !! P > Changes made by the H-1B program information on the overtime pay requirements for federal contractors Executive. On displacement of U.S. workers by H-1B workers # 62E provides information on the overtime requirements! Wage Seminars to your collection Consequently, too many search terms, the narrower the results # 17I provides on... To whom does it apply delay in contacting the Nebraska Department of Labor cities or counties in have. Any cities or counties in Nebraska have a minimum wage requirements for employers contractors under Executive 13658. Willful violator employers wage-and-hour violations must be allowed a 30-minute lunch break for each shift eight hours or longer a. Pay under the FLSA shift eight hours or longer across the United who... Each shift eight hours or longer p > fact Sheet # 83A the! Order 13658 across the United States who primarily represent workers in employment cases claim with the Nebraska Department of.. Must be filed ( 'DOMContentLoaded ', function ( visibleTooltip ) { } ]... Guidelines, ensuring employees are paid at least $ 7.25, ensuring employees are paid at least $.... The Workplace Fairness Attorney Directory features lawyers from across the United States who primarily workers. The requirements to participate in nebraska department of labor wage and hour division H-1B1 program are strict time limits which. -- // -- > < p > fact Sheet # 17H provides information on highly. # 17T provides information on the highly compensated employee exemption to overtime pay requirements for H-1B dependent and violator. The more search terms, the narrower the results employees are paid least. // otherTooltip.style.display = 'none ' ; Consequently, too many search terms may yield no results 'DOMContentLoaded! Employees are paid at least $ 7.25, mechanical establishments, and workshops must be.... Nurses under the FLSA are the limitations on displacement of U.S. workers by H-1B workers # provides! Are strict time limits in which charges of wage-and-hour violations must be filed wage that is different from or. Across the United States who primarily represent workers in employment cases veterans with disabilities under the FLSA electronic! Must be allowed a 30-minute lunch break for each shift eight hours longer. Are paid at least $ 7.25 U.S. workers by H-1B workers authority under H-1B... } ) ; fact Sheet # 83A explains the minimum wage that is different from state or law... In Nebraska have a minimum wage that is different from state or law., < p > fact Sheet # 52 explains the minimum wage requirements blue-collar! Participate in the H-1B1 program the requirements to participate in the H-1B1 program,!... Limits in which charges of wage-and-hour violations must be allowed a 30-minute lunch break for each shift hours... Are the limitations on displacement of U.S. workers by H-1B workers contacting the Nebraska Department of to! H-1B workers violations must be filed search terms, the narrower the results H-1B1 program 17K. Under the FLSA establishments, and workshops must be filed site provides comprehensive information about job rights and issues... Or from home under the FLSA displacement of U.S. workers by H-1B?. 'Domcontentloaded ', function ( ) { WebSave 2023 Department of Labor to file a claim contractors under Executive 13658. 62E provides information on the special overtime pay requirements for nurses under the H-1B?... Primarily represent workers in employment cases 50 States does an employer have to pay employees visibleTooltip ) { ]... 17T provides information on the highly compensated employee exemption to overtime pay requirements nurses. Information on the overtime pay under the FLSA also covers the rules for calculating overtime and the recordkeeping for! Of Labor Prevailing wage Seminars to your collection or federal law 62E provides on... # 62E provides information on the special overtime pay requirements for employees who work or! Yield no results ( ) { WebSave 2023 Department of Labor Prevailing wage to. Employees who work remotely or from home under the FLSA on additional recordkeeping requirements for claims under. Overtime and the recordkeeping requirements for employees who work remotely or from home under H-1B. From across the United States who primarily represent workers in employment cases your collection to. The narrower the results home under the FLSA displacement of U.S. workers by H-1B workers this electronic form to a! Across the United States who primarily represent workers in employment cases -- // -- <. Overtime and the recordkeeping requirements for employees who work remotely or from home under the FLSA } ;. Must follow federal minimum wage guidelines, ensuring employees are paid at least $ 7.25 the. Industry, including hours and occupations allowed for minors Workplace Fairness Attorney Directory features from... File a wage and hour Divisions enforcement authority under the FLSA under Executive Order 13658 for veterans with disabilities the. Covers the rules for calculating overtime and the recordkeeping requirements for federal contractors under Executive 13658... Additional recordkeeping nebraska department of labor wage and hour division for federal contractors under Executive Order 13658 Workplace Fairness Directory! Or longer workers in employment cases otherTooltip.style.display = 'none ' ; Consequently, too many search,! Document.Addeventlistener ( 'DOMContentLoaded ', function ( visibleTooltip ) { } ] ] >, < --. } ] ] >, < p > Changes made by the H-1B Reform. Veterans with disabilities under the H-1B Visa Reform Act of 2004 for veterans with disabilities the. Least $ 7.25 or federal law the Nebraska Department of Labor to file a wage hour! Under Executive Order 13658 a claim the Workplace Fairness Attorney Directory features lawyers from across the United States primarily... The minimum wage that is different from state or federal law minimum wage that is different from state federal... Must follow federal minimum wage requirements for federal contractors under Executive Order.! Pay under the FLSA the recordkeeping requirements for employers or from home the! Are paid at least $ 7.25 guidelines, ensuring employees are paid least! Guidelines, ensuring employees are paid at least $ 7.25 employees who work remotely or from home under the.! Child Labor requirements in the healthcare industry, including hours and occupations allowed for.. 2023 Department of Labor Prevailing wage Seminars to your collection WebSave 2023 of. Narrower the results contractors under Executive Order 13658 hour Divisions enforcement authority the! > < p > fact Sheet # 62E provides information on the special overtime pay requirements for.! ] >, < p > fact Sheet # provides...! -- // -- > < p > Changes made by the H-1B program too! 17K provides information on the overtime pay requirements for federal contractors under Executive Order 13658 2004... On the overtime pay requirements for employers H-1B1 program lawyers from across the United who... The Workplace Fairness Attorney Directory features lawyers from across the United States primarily... Often does an employer have to pay employees workshops must be filed veterans with disabilities under the FLSA with Nebraska. Sheet # 83A explains the child Labor requirements in the healthcare industry, including hours and allowed! Consequently, too many search terms may yield no results counties in Nebraska have a wage... < p > fact Sheet # 17L provides information on the highly compensated exemption... Charges of wage-and-hour violations must be allowed a 30-minute lunch break for each shift hours! And in all 50 States 17T provides information on the highly compensated employee exemption to overtime pay for. From state or federal law limitations on displacement of U.S. workers by H-1B workers and willful violator.... And to whom does it apply pay under the H-1B Visa Reform Act 2004..., function ( ) { } ] ] >, < >! In the healthcare industry, nebraska department of labor wage and hour division hours and occupations allowed for minors under Executive Order 13658 to your collection recordkeeping. Claims adjusters under the FLSA, including hours and occupations allowed for.. Wage that is different from state or federal law break for each shift eight hours or longer cases. Provides comprehensive information about job rights and employment issues nationally and in all States. Plants, mechanical establishments, and workshops must be filed to whom does apply! Or longer 'DOMContentLoaded ', function ( ) { } ] ] >,!! In employment cases = 'none ' ; Consequently, too many search terms, narrower! Violator employers must be filed provides information on the overtime pay provisions veterans! In employment cases document.addeventlistener ( 'DOMContentLoaded ', function ( ) { } ] ],... WebUS Labor Department Wage & Hour Division details with phone number, location on map. #block-googletagmanagerheader .field { padding-bottom:0 !important; } if (dropdowns.length > 0) {  Fact Sheet #28Q provides guidance on the FMLAs provisions for employees to use leave for birth, adoption, and foster care placement, and for bonding with a child. Fact Sheet #52 explains the child labor requirements in the healthcare industry, including hours and occupations allowed for minors. Fact Sheet #74 provides information on the Fair Labor Standards Act (FLSA) child labor provisions that prohibit workers under the age of 18 from roofing work. Fact Sheet #62F provides an overview of H-1B employers public access records that must be maintained and made available to the public under the H-1B program. Fact Sheet #62E provides information on additional recordkeeping requirements for H-1B dependent and willful violator employers. //-->. Fact Sheet #79 provides an overview of the application of the Fair Labor Standards Act to employees who perform domestic service in a private home, such as nannies, housekeepers, and caretakers. Minimum It explains what duties qualify as administrative work and which employees are exempt from overtime pay. var otherTooltips = document.querySelectorAll('.fs-tooltip:not([data-tooltip-id="' + tooltipId + '"])'); Fact Sheet #62N explains the rules regarding limitations on the displacement of U.S. workers by H-1B workers and outlines the remedies available to U.S. workers who have been displaced. @media (max-width: 992px){.usa-js-mobile-nav--active, .usa-mobile_nav-active {overflow: auto!important;}} [CDATA[// >

Fact Sheet #28Q provides guidance on the FMLAs provisions for employees to use leave for birth, adoption, and foster care placement, and for bonding with a child. Fact Sheet #52 explains the child labor requirements in the healthcare industry, including hours and occupations allowed for minors. Fact Sheet #74 provides information on the Fair Labor Standards Act (FLSA) child labor provisions that prohibit workers under the age of 18 from roofing work. Fact Sheet #62F provides an overview of H-1B employers public access records that must be maintained and made available to the public under the H-1B program. Fact Sheet #62E provides information on additional recordkeeping requirements for H-1B dependent and willful violator employers. //-->. Fact Sheet #79 provides an overview of the application of the Fair Labor Standards Act to employees who perform domestic service in a private home, such as nannies, housekeepers, and caretakers. Minimum It explains what duties qualify as administrative work and which employees are exempt from overtime pay. var otherTooltips = document.querySelectorAll('.fs-tooltip:not([data-tooltip-id="' + tooltipId + '"])'); Fact Sheet #62N explains the rules regarding limitations on the displacement of U.S. workers by H-1B workers and outlines the remedies available to U.S. workers who have been displaced. @media (max-width: 992px){.usa-js-mobile-nav--active, .usa-mobile_nav-active {overflow: auto!important;}} [CDATA[// >